The Asset Management Strategy provides an overview of our land and property estate, together with the main priorities for managing and developing that estate over the next five years.

The Strategy will be reviewed and amended within three years to ensure the estate fully supports the Community and Corporate Plan 2019-2023, by contributing to the key objectives for property asset management.

Land and buildings

Our property portfolio comprises over 1,800 land and building assets, with a total gross book value of £502m, as of 31 March 2024. The total annual rental income generated from the estate is c. £19.4m. There is a wide range of assets within the corporate estate, which includes our investment portfolio, offices, car parks, depots, schools and assets leased to community organisations. The book value is not necessarily the exact amount that could be realised if all the assets were sold, but it does demonstrate the extent of our land and buildings and why they need to be carefully managed.

The assets deliver a mixture of front-line services and indirect service provision. Many of the assets are legacies from donations, local government reorganisations and previous acquisitions. We have undertaken a significant rationalisation exercise of its estate over the last 10 years resulting in the size of the operational estate particularly being reduced. However, the ongoing careful management and continuous review of assets is imperative to avoid the possibility of money being wasted by retaining assets that are past their useful life. Equally, an asset beyond its useful life will still retain a value, whether this is financial or social. Consequently, if these assets are surplus, we should look to dispose and release the value so the capital can be re-invested elsewhere.

Following the COVID-19 pandemic, there will be changes to the way we work and some services will be delivered differently. As a result, some assets will need to change as we move forward over the next 3 to 5 years. We may need to invest further in our existing assets or provide some new assets to deliver services that are fit for a new way of working. We equally need to consider measures to be taken in relation to minimising energy and water use to meet its carbon neutral 2030 targets.

To assist in this process we will, where appropriate, fully embed the Corporate Landlord model. This will maximise value for money and make the most efficient use of our property assets, ensuring capital works, both reactive and planned are prioritised appropriately. We will obtain up to date condition data and align this information with operational priorities. We will also adopt an Asset Challenge process which ensures a robust approach is undertaken providing confidence that any decision regarding future use of a property provides the best and most appropriate output.

This Asset Management Strategy will ensure that each asset is categorised, by property type, into one of seven asset groups. The reasons for holding these assets will vary and as a result, we may need to measure performance in different ways. Nevertheless, the performance of each asset and each group must therefore be linked to the strategic purpose for holding it.

Set out below is the definition for each of the asset groups:

Community assets

Community assets are those assets that we intend to hold in perpetuity that can promote social inclusion and improve the health and well-being of citizens. This includes public open spaces, memorials, parks, shelters, sports pitches and public toilets. The assets which are often legacies from donations will have no determinable useful life and which may, in addition, have restrictions on their disposal. This asset schedule is nevertheless a significant proportion of the asset base with 670 assets and a gross book value of £9.7m. There is a significant ongoing maintenance liability with community assets.

Heritage assets

Heritage assets are those assets that are intended to be preserved in trust for future generations because of their cultural, environmental, or historical associations/significance. We have 43 heritage assets, including for example Torre Abbey and Torquay Pavilion which are held by us in pursuit of its overall objectives in relation to the maintenance of our heritage and culture.

Heritage assets can include historical buildings, archaeological sites, military and scientific equipment of historical importance, historic motor vehicles, civic regalia, orders, and decorations (medals), museum and gallery collections and works of art. This asset schedule has a gross book value of £26.2m.

Infrastructure assets

Infrastructure assets are long lasting tangible assets that add value and are an integral part of land and buildings. These assets tend to be part of a larger component or system for example linked to transport, communication, water, sewage, bridges, and sea defences and need to be maintained to ensure functionality in the delivery of effective and efficient delivery of services. A significant proportion of the 102 infrastructure assets relate to the harbour estate. The gross book value of this schedule is £39.8m.

Investment assets

Investment assets are those assets held by us solely for the purpose to earn rental income or for capital appreciation or both. Our investment portfolio is divided into two groups of assets.

Portfolio A – is the schedule of 20 investment assets that have been purchased via the Investment Fund since 2018. These assets have been purchased through borrowing from the Public Works Loan Board. Any future disposal of Portfolio A assets will be subject to the criteria as defined within the borrowing agreements.

| Portfolio A | Number of assets | Rental Income PA |

|---|---|---|

| Hotel | 1 | £313,000 |

| Industrial | 5 | £5,213,000 |

| Leisure | 1 | £591,000 |

| Office | 4 | £3,638,000 |

| Retail | 9 | £2,628,000 |

| Total | 20 | £12,383,000 |

Portfolio B – is a schedule of assets where the rental income for each asset exceeds £20,000 pa and formed part of our original let estate, prior to 2018. This schedule comprises of 24 assets with a gross book value of £32.5m. The assets comprise a range of property types including for example a golf course, caravan site, leisure facilities, restaurants, and cafes. They produce an annual rental income of £2,322,000.

Leased estate, other land and buildings

The Leased Estate includes those remaining assets that generate an income but are not captured in the Investment portfolios and totals c.890 assets with a gross book value of £154m. These assets have in the past been used to perform functions/services done directly by the Authority but are now let to third parties to perform for example, beach/park cafes. Other land and buildings include a plethora of other leases and licences, such as small pieces of fringe and highway verge land, substation sites and other low value assets. The rental income is nevertheless substantial equating to £4.6m pa.

Operational assets

Operational assets are those assets used to deliver front line services and the daily operation of the business for us. This comprises of 20 assets with a gross book value of £5.3m and includes corporate office accommodation and service buildings. (Operational assets used to deliver the harbour authority function are included in the Infrastructure Assets group)

Surplus assets

Surplus assets are those assets that have been declared surplus to our operational requirements. Often the assets are close to or beyond useful economic life. These assets should be open for disposal or consideration for a community asset transfer.

TDA will produce an annual Estate Dashboard recording the overall performance of the property portfolio:

Council finances

Like many other Councils, we have experienced significant funding reductions over the last 5 years. We have seen a reduction in its Revenue Support Grant from £27m in 2015/16 to £6m by 2019/20. It is still uncertain what our funding will be in future years. Despite these financial challenges we are committed to supporting growth and investment through our Capital Programme and will look to intervene where the market is failing. We continue to deliver our Investment and Regeneration Strategy, which is generating revenue income, as well as enhancing, and supporting the economic performance of Torbay. Our assets must also be worked harder to be able to contribute to the overall corporate and service objectives for example, the proposal to redevelop the old toilet blocks at Preston and Corbyn Head, the Old Toll House, Torquay and the Terrace/Harbour Car Park, Torquay.

Current and recently completed Capital Projects include:

- Fleet Walk Shopping Centre, Torquay - Using its Economic Growth Fund, we purchased this asset in November 2019, as part of its plans to regenerate Torbay’s town centres.

- EPIC White Rock, Paignton - An £8m Electronics and Photonics Innovation Centre (EPIC) opened in summer 2019 supporting tech innovation and promoting collaborative activities in an excellence cluster between businesses and research institutions. This building has now been leased on a long leasehold basis to TDA. The asset is currently 65% let and ahead of TDA business plan for the centre.

- Harbour Light Redevelopment, Paignton Harbour - A new bar and dining venue overlooking Paignton Harbour, opened in February 2020 after St Austell Brewery’s investment. The project was a product of the Port Masterplan and promoted by the Tor Bay Harbour Committee.

- Oxen Cove Jetty, Brixham - A £2.5m project jointly funded by us and the European Maritime Fisheries Fund to provide additional landing capacity to support the fishing industry by easing demand at peak time and streamlining the logistics of distribution at Brixham Fish Market.

Asset challenge

Due to the ongoing financial challenges facing the Authority and the further future reductions in Revenue Support Grants (RSG), unless there is specific approval at Full Council to the contrary, we will always seek to maximise revenue streams and the full market receipt whether by way of freehold disposal or leasehold interest from assets classified as investments, leased estate, other land and buildings. Disposal of other asset groups whether by way of freehold disposal or leasehold interest will be considered alongside community aspirations and due regard to the purpose of ownership, including the operation of our services.

It is intended that all assets that are assessed as surplus and/or not required for operational purposes should be reviewed through the Asset Challenge process. This provides confidence that any decision regarding future use of a property provides the best and most appropriate output. It should be noted that best value in terms of a capital receipt is not always the right outcome, and we needs a mix of revenue, capital and place shaping outputs.

The process of decision making on future asset usage, project delivery and the disposal of sites shall be determined in two parts:

Part 1 - the Corporate Assessment

- Strategic purpose - This part of the process determines whether an asset has an identified use and purpose which enables service delivery in line with corporate and service strategies. For example, where there is an identified need within a specified location by multiple services, these are co-located within a multi-functional hub, therefore, enabling asset consolidation and reduction in running costs. Additionally, this could be identifying assets that could support service delivery, for example, extra-care sheltered housing that reduces expenditure on high-cost care, but also delivers important outcomes to residents.

- Opportunities and risk - The second part of this assessment is understanding if there are any opportunities that could be exploited. Do we fully understand the cost and condition of a building or asset; is this is a low performing/high-cost asset in poor condition that is not fit for purpose and requires significant investment? If so, it may not be an asset to retain.

- Performance appraisal - We also need to understand what financial and non-financial outcomes are being delivered and can they be quantified. Understanding the management costs are equally important. Assets may be retained where there is a clearly defined, future strategic purpose, which has a value and can be delivered within an agreed timeframe. Cost/benefit analysis of investment, to make the asset fit for purpose, with an appropriate payback period, relevant to length of future use.

The Asset Challenge process sets out the stages of this assessment, and what happens in each case. If the asset is not suitable or not needed for either purpose, it moves to Part 2.

Part 2 - the Option Appraisal

- Option appraisal - This part of the process focusses on the use of the asset beyond service or operational requirements. This is a balance of performance, opportunities and risks. This might include a site that could be disposed of for a capital receipt; redeveloped for revenue income generation or held for future strategic use to maximise output or benefit. The primary process is a formal options appraisal which considers potential future uses of the site. The options appraisal will identify the preferred option and how this best aligns with the Community and Corporate Plan.

- Pre-implementation consultation - Partnership working and shared development where opportunities will deliver quantifiable benefits. There will be a need to engage with both internal and external stakeholders and partners. A key factor is whether an asset supports economic growth and improves on the ‘place’.

- Outcome - The outcome of the assessment will decide whether an asset is retained, remodelled and re-used or disposed of through the open market or by way of a community asset transfer.

Future ways of working

Future ways of working is our forward-looking programme, forming part of the overarching transformation programme, building on the work of the previous Office Rationalisation Programme. Fundamental to the success of the programme is not making snap decisions about individual assets, without a holistic view being taken. An example of this would be the future of Paignton Library, our only forward-facing asset in Paignton.

The outbreak of the Coronavirus - COVID 19 demonstrated the resilience introduced throughout our workforce with the transition of hundreds of employees to home working for a sustained period. Enabled by a conscious shift to align roles to workstyles that allow a high degree of agility, supported by ICT equipment and infrastructure and relevant policies and procedures to support a new way of working.

The key drivers for the new programme will be developed in greater detail over the next 12 months. The programme will enable more efficient home and team-working, working more flexibly within our buildings and homes, through the promotion of agile working, and providing modern fit-for-purpose workplaces, supplemented with the correct tools for greater home-based working, where appropriate. Closing or repurposing buildings and space within those buildings will naturally follow as we build up intelligence of our future needs.

- Addressing the essential maintenance needs of our remaining buildings - maintaining the portfolio mechanical and electrical (M&E) systems and prolonging their operational lifespan; addressing critical structural issues.

- Complying with regulations - ensuring that actions are taken to ensure that buildings are compliant with statutory obligations for example in respect of Fire, Legionella and Asbestos.

- Optimising income - protecting existing income streams from assets and investing in buildings where additional income can be generated.

- Using less energy - improving energy efficiency in our offices and other buildings and reducing running costs.

- One Public Estate - county wide collaboration on asset management to enable Public Sector providers to collaborate on strategic planning and management of their land and buildings as a collective resource.

- Serving our customers more efficiently - focusing on what our customers want and need, using better accessible and inclusive facilities to serve them.

Climate change: De-carbonisation

In May 2019, the UK Parliament declared an Environment and Climate Emergency, and the government amended the 2008 Climate Change Act to strengthen its climate ambition, legislating for a target to reduce the UK’s emissions to Net Zero by 2050. Like many local authorities, we recognised the scale and urgency of the situation by declaring a Climate Emergency of its own, in June 2019, and by joining the Devon Climate Emergency Response Group. This group is made up of Devon’s councils, emergency services and leading business groups. Working towards the Devon Carbon Plan, Torbay Council set out its clear objective to become a Carbon Neutral Council by 2030 and work with others to create a carbon neutral community. Other measures adopted to address climate change include:

- Increase recycling rates.

- Reduce Torbay’s carbon footprint.

- Encourage a sustainably developed built environment.

- Implement re-wooding and rewilding.

- Address flooding risks.

- Improve communications and transport connectivity and sustainability.

- Granting of ‘green’ leases.

To achieve carbon neutrality within our own estate requires significant resource and effort.

We have committed to developing its own carbon neutral action plan by April 2022. As part of this we will work with TDA to ensure a roadmap with actions on how we intend to work towards a carbon neutral estate by 2030.

We will also develop with partners a Torbay wide carbon neutral plan and refresh the Energy and Climate Change Strategy (2014 – 2019) by April 2022.

March 2021

- Initial CN Torbay Action Plan

- 10 actions 2021

March 2021 to April 2022

- CN Council Programme

- New CN Council Action Plan 2022 onwards

- Officer group, policy and training

March 2021 to April 2022

- Co-develop CN Torbay Action Plan 2022 onwards

- Climate mitigation and adaptation

- Stakeholder Engagement Plan

We will work in reducing our environmental impacts and become carbon neutral by 2030 by adhering to the following principles:

- Reduce energy & carbon emissions by the adoption of energy efficient measures, renewable energy tariffs and staff behavioural initiatives.

- Minimise waste and water consumption through waste reduction, reuse, and recycling.

- Use sustainable resources through the things we purchase and the services we commission.

- Enhance our natural environment by protecting the Council’s own estate through a range of conservation practices.

- Climate resilience and the better understanding of the near-term and future risks on climate change for the Council’s operations and services.

- Improve communications and transport connectivity and sustainability.

- Granting of ‘green’ leases.

Maintaining our assets and corporate landlord approach

The way we manage our assets is important. We need to ensure that, where appropriate, our land and buildings are managed as a centralised corporate resource, the right stakeholders are involved, and decisions are made in the context of our priorities and objectives.

The concept of a Corporate Landlord Approach is that the ownership of an asset and the responsibility for its management and maintenance is transferred from service areas into a corporate centre. The service area then becomes a corporate tenant and their priority is to plan and deliver their service to the best of their ability. The Corporate Landlord’s function is to ensure all services are adequately accommodated and to maintain and manage the associated land and property assets.

Although a Corporate Landlord ‘lite’ approach has been adopted this has only been completed in part. The Corporate Landlord’s responsibility should extend further than the acquisition, development and disposal of land and buildings. Over the life of the strategy the Corporate Landlord will be delivered further to assume more responsibility for asset planning, review, feasibility and options appraisal accounting for the needs of most service areas, but more importantly, making decisions based on overall corporate priorities.

The overall asset maintenance strategy should be to ensure that our finite and reducing resources are prioritised to appropriate buildings, where the money is needed most. To identify these priorities a programme of condition surveys will be undertaken to understand maintenance requirements over a rolling period of 5 years. The aspiration should be to complete lifecycle condition surveys on selected assets to cover a period of 25 to 30 years. This will enable a better-informed decision-making approach and maximise efficiencies by planning over a longer time horizon, instead of reacting to maintenance emergencies as they happen.

Moving forward, the four key aims for both Corporate and Schools Building Maintenance should be:

- To ensure our buildings are safe and secure for the people who use them.

- To allocate funding to projects that will achieve the maximum positive impact for those who use them including our customers.

- To achieve an efficient balance between planned and reactive maintenance work.

- Achieving maximum efficiencies in the way we procure building maintenance work.

TDA will deliver the Corporate Landlord Model, as directed by us, through the use of the following activities:

- Design and Project Management

- Statutory Compliance of Buildings – H&S

- Energy Management

- Management of Repairs and Maintenance

- Facilities Management

- Estates and Valuations

- Strategic Asset Management Planning

- Management of Investment Portfolio

- Building Maintenance

Day to day performance and management of the asset portfolio is a commissioned service undertaken by TDA.

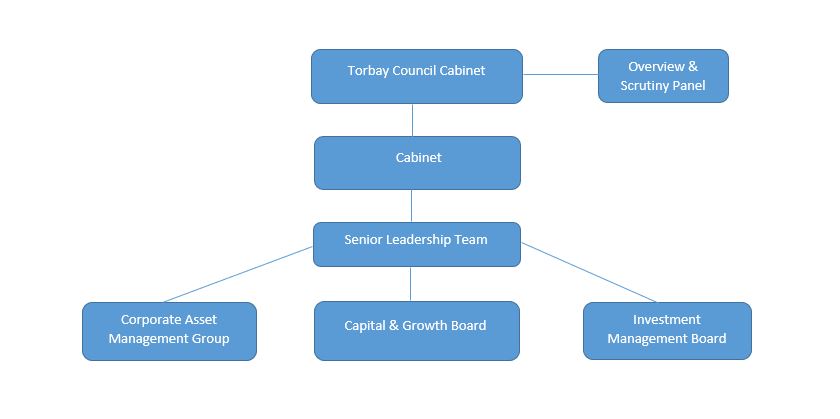

We shall ensure there is a robust governance structure in place providing direction and transparency of the management of our estate.

The diagram below outlines the organisational structure for the governance of our land and building assets.

Working with partners

We are active members of the One Public Estate (OPE) programme, working closely with other public sector organisations across the sub-region (Devon OPE Board), exploring opportunities to reduce premises costs and make assets work better for our communities and customers. This includes working with Torbay & South Devon NHS Trust through the Integrated Care Organisation delivering community health and adult social care services for Torbay. Other partners for example include Devon and Cornwall Police, South Devon College and Libraries Unlimited.

The key aim is to work with a range of key stakeholders, exploring opportunities for shared services and how our combined assets can support this. We will also continue to be an active member of the Heart of the South West LEP Joint Committee and the Emerging Greater South West proposals.

There are many more opportunities across Torbay to explore asset-based arrangements including shared space and community/public service points which will encompass the needs of our communities.

- Torbay and South Devon NHS Foundation Trust

- Environment Agency

- Local Government Association

- Homes England

- Network Rail

- Ministry of Housing, Communities and Local Government

- Torbay Coast and Countryside Trust

- Department for Work and Pensions

- Torbay Community Development Trust

- Marine Management Organisation

One Public Estate

The strategic objectives of the One Public Estate programme are set out below:

- Delivery efficiency savings

- Work closely with community and voluntary organisations

- Contribute to wider economic and social outcomes

- Delivery of greater savings in running costs

- Provide improved access to public services

- Improve joined up and customer focussed services

Engaging with communities

We lease over 44 land and property assets to voluntary, community and sports organisations, often at reduced or minimal rents. Many of these leases have been in place for a number of years. Other leases have been transferred to local organisations who run them successfully for the benefit of our local communities. These arrangements range from short term licences, sports leases for up to 40 years or granted by way of a more formal process under a ‘Community Asset Transfer’ (CAT).

Local people are often best placed to manage community facilities in their area. They already make excellent use of these assets with local knowledge and hands on management, often resulting in lower overheads and better value for money outcomes. Community organisations can lever in significant funding and are also able to use volunteers to run facilities.

Fundamentally, community groups can take ownership of assets and have great pride in their local area. Managing these facilities can help empower local communities and can bring opportunities for greater independence and financial sustainability. We are fully committed to using appropriate assets to form long term partnerships with suitable voluntary, community and sports organisations.

A number of operational Policies are in place that will be followed in relation to applications for Community Asset Transfers and Sports Leases.

- Community Asset Transfer Policy

- Sports Lease Policy

- Grant in Lieu of Market Rent Application

Conclusion and our forward plan

This document covers the two elements of the new Asset Management Framework - (1) the Asset Management Policy and (2) the Asset Management Strategy and together they make up the Strategic Asset Management Plan. The Strategic Asset Management Plan outlines the key strategic objectives for our land and buildings over the next five years and it will form part of the our overall Policy Framework.

Sitting outside of the Asset Management Framework is the Asset Management Action Plan, which further describes the specific activities to achieve these objectives, categorised under two thematic headings of Strategic and Operational Actions. The Action Plan is a live document and will be reviewed and monitored regularly by Cabinet. It will continually change to reflect achievements of actions and capture new priorities and initiatives as they are identified. Consequently, the Asset Management Action Plan will not be a policy document.